Thank you for using the English version of the JTL-Guide!

We are currently still building up the English documentation; not all sections have been translated yet. Please note that there may still be German screenshots or links to German pages even on pages that have already been translated. This guide mostly addresses English speaking users in Germany.

We are currently still building up the English documentation; not all sections have been translated yet. Please note that there may still be German screenshots or links to German pages even on pages that have already been translated. This guide mostly addresses English speaking users in Germany.

Manually exempt sales orders from VAT

Your task/initial situation

You sell your products in regions where fiscal particularities apply and want to process your sales orders correctly in terms of accounting and tax. Example: Your customers live in Germany on a NATO base or on the high seas island of Heligoland and order goods from your company. In these cases, you want to manually exempt certain sales orders from the VAT.

Exempt sales orders from VAT

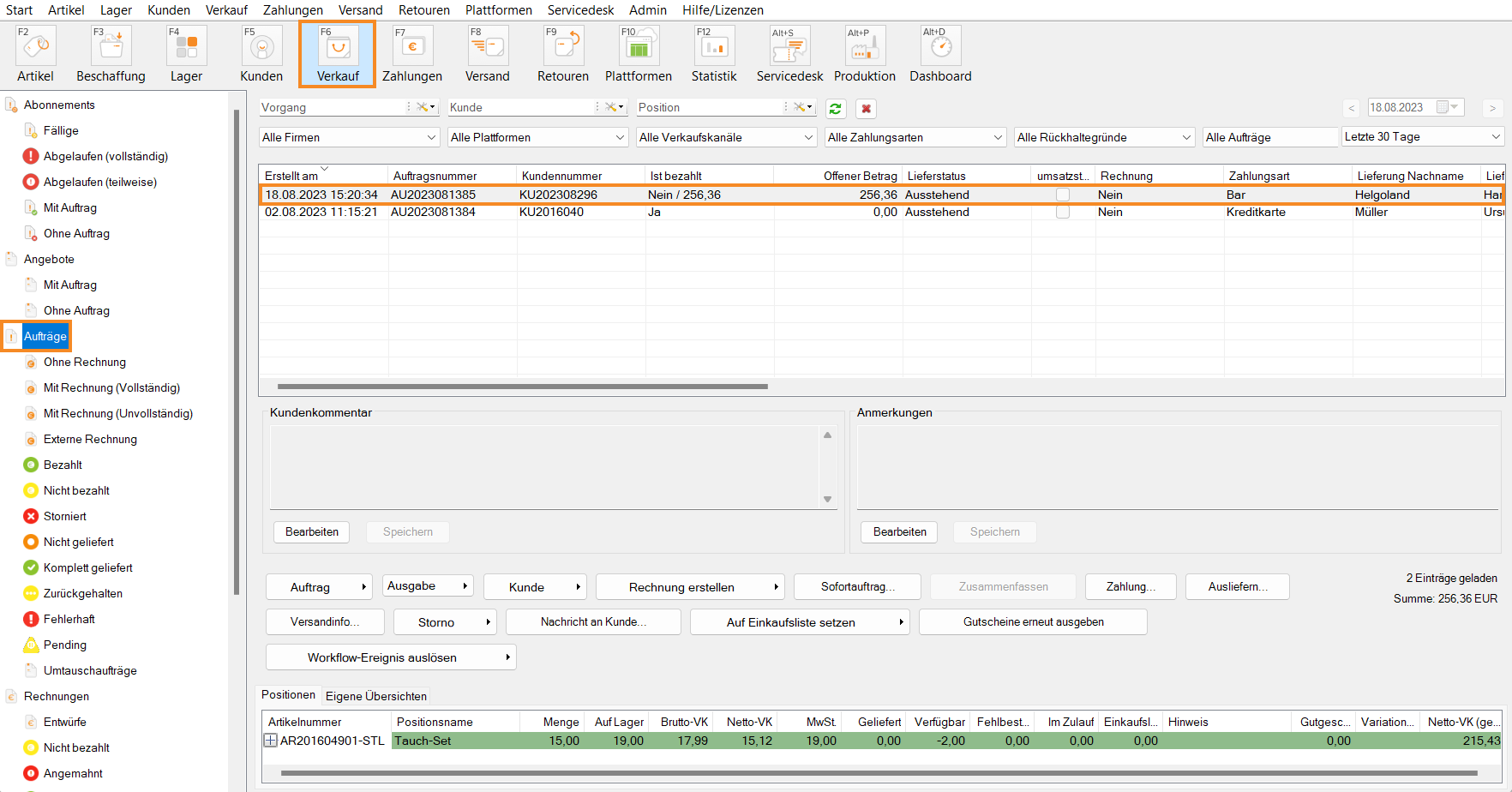

- Go to JTL-Wawi and click on the Sales icon to go to the sales management.

- Double-click on the sales order in the overview that you want to manually exempt from VAT. The sales order master data opens.

- In the Special treatment drop-down menu, select Exempt from VAT.

- In the query, select whether you want to keep the gross or net prices and confirm with Save.

- Close the sales order master data by clicking Close. This sales order is now exempt from VAT.

Note: You have the option of automating this process via a workflow. In this way, you can always exempt all sales orders from Helgoland, for example, from VAT via a workflow. For more information on this topic, click here: JTL-Workflows.