Invoicing fulfilment customers

Your task/initial situation

As a fulfilment service provider, you provide a billable service to your customers. This page explains how invoicing works in the JTL-Fulfillment Network. We will explain to you which invoicing options you have in the JTL-Fulfillment Network and how to create the most important invoicing types.

Invoicing types

In principle, you can invoice any kind of service in the JTL-Fulfillment Network. Fixed costs can also be included in invoicing. The framework contract that you concluded with your fulfilment customers will certainly be the decisive factor here. The types of invoicing mentioned below are usually in high demand. If you have special requirements, we recommend that you hire a service partner to set up the invoicing. They usually have a lot of experience in this field and can quickly achieve the desired result.

Possible invoicing types and how to calculate them:

- Storage costs: You can set the storage costs according to various criteria such as the storage space occupied at the end of the day or month. For more information, please read the instructions on Invoicing storage costs.

- Fees per delivered sales order: You can calculate a flat rate for delivered sales orders. See Invoicing costs on the basis of shipping methods.

- Fees per picking process: You can charge for every single picking you perform. You can decide whether each picking costs the same or whether the first picking is more expensive than the following ones. See Invoicing costs on the basis of shipping methods.

- Shipping costs: You can charge the shipping costs per package to your fulfilment customer. See Invoicing costs on the basis of shipping methods.

- Labelling: You can pass on the cost of labelling items to the merchant. This is usually done via a manual workflow that is triggered directly during labelling. See Invoicing labelling.

- Fees for returns

- Fees for the finishing of goods

- Fees for checking goods receipts

Determination of the invoicing type

First, you must decide how you want to bill your customers.

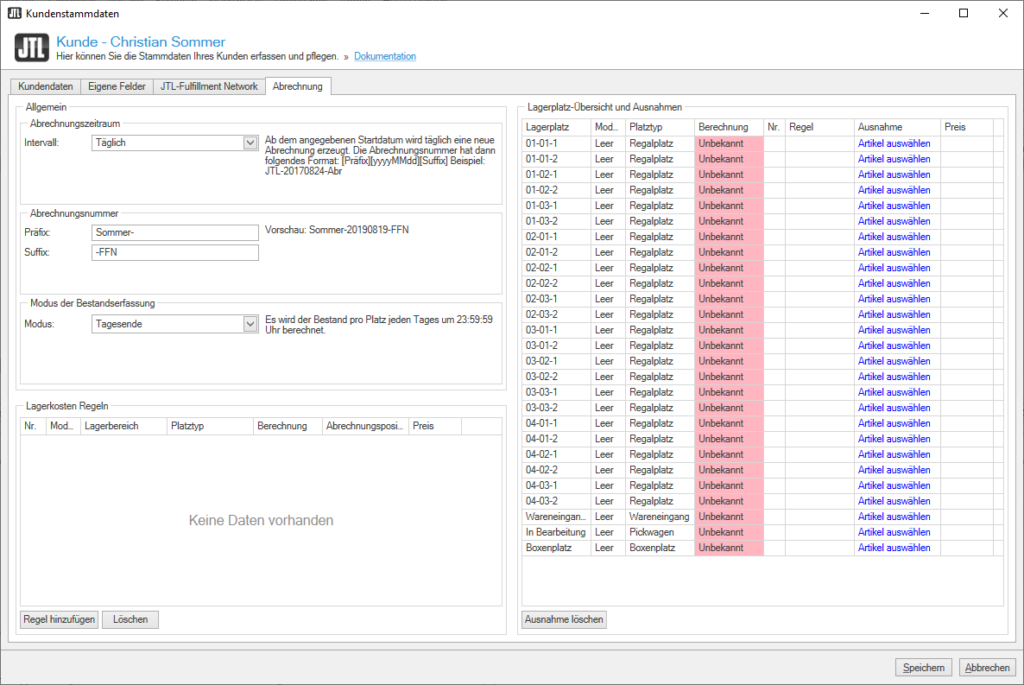

- In JTL-Wawi, open your customer’s customer master data in the Kunden (Customers) area. Then go to the tab Abrechnung (Accounting).

- Under Abrechnungszeitraum (Accounting period), specify how often invoices are to be created.

Intervall (Interval): Here you determine which range of time an invoice should cover.

- Täglich (Daily): The invoice is created at the end of each day at 23:59, even on weekends and public holidays. Storage costs are incurred every day, variable costs are incurred depending on the actions carried out.

- Wöchentlich (Weekly): The invoice is created after 7 days at the end of day 7 at 23:59. Use Beginn Intervall (Start interval) to specify which day should be the first day of the week.

- Dekadisch (Decadal): The invoice is created after 10 days at the end of day 10 at 23:59. Use Beginn Intervall (Start interval) to specify the date on which the accounting period is to start.

- Halbmonatlich (Fortnightly): The invoice is created in the middle and at the end of the month. Use Beginn Intervall (Start interval) to specify which day should be the first day of the accounting month.

- Monatlich (Monthly): The invoice is created exactly at the end of a month. Use Beginn Intervall (Start interval) to specify which day should be the first day of the accounting month.

- Define a rule according to which the accounting number is created.

The accounting number consists of three parts:

- Prefix: This part is always placed at the beginning of each accounting number. It might, for example, be an abbreviation of the merchant’s name.

- Consecutive number: This results from the settings made under Abrechnungszeitraum (Accounting period).

- Suffix: This part is always placed at the end of each accounting number.

Please note: Prefix and suffix can also be left empty. However, we recommend that you use at least one of the two fields so that you can assign unique accounting numbers to a fulfilment service provider.

- Specify the Modus der Bestandserfassung (Inventory recording mode).

Possible options are:

- NichtErfassen (NoRecording): No storage costs will be charged.

- Abrechnungsende (InvoiceCreation): The stock levels are recorded at the time of the invoice creation. It is irrelevant whether the stock levels were greater or smaller before that moment.

- Tagesende (End of day): Prices for a storage location are calculated every day at 23:59 and are included in the invoice. The basis for this calculation is the stock level at the end of the day.

- TagesendeMax (EndOfDayMax): Prices for a storage location are calculated every day at 23:59 and are included in the invoice. The basis for this calculation is the maximum stock level of the day.

- Platzpauschale (Storage location flat rate): All storage locations assigned to a merchant are charged irrespective of whether they were occupied or not. The assignment is made by assigning a price to all storage locations that are reserved for a merchant. See Calculating storage costs.

- Extern (Externally): The calculation takes place in an external system. To do this, an SQL procedure is used, which you or a service partner can define yourself.

- Save and close the dialogue box by clicking Speichern.

Creating accounting items

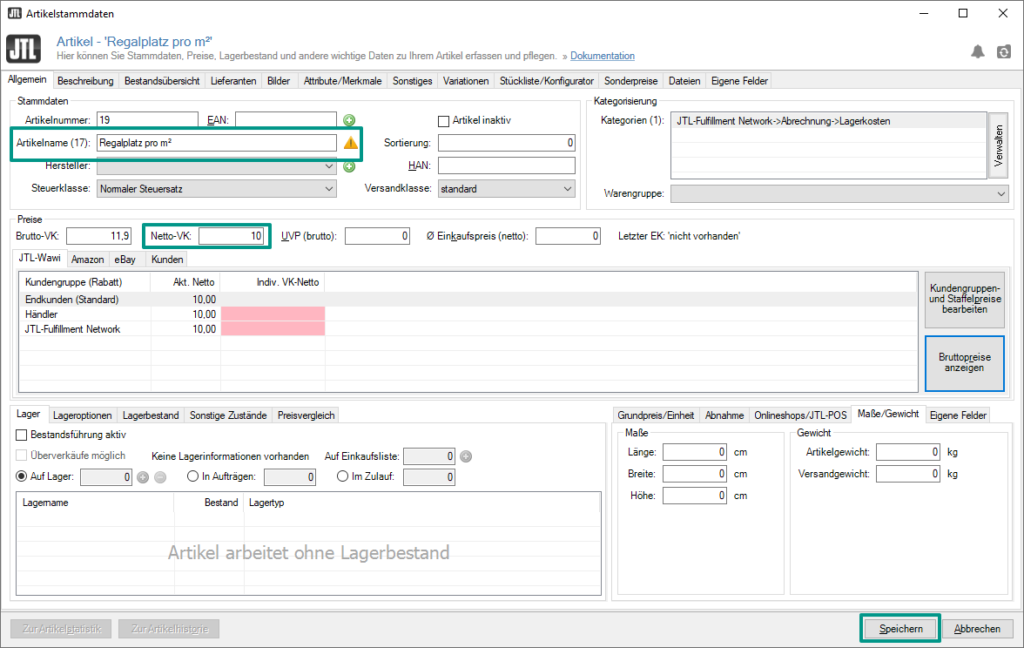

You must create a separate item for each individual line item that you want to invoice. The general procedure is always the same, so we will show you the normal procedure here using an accounting item for one rack space per m³.

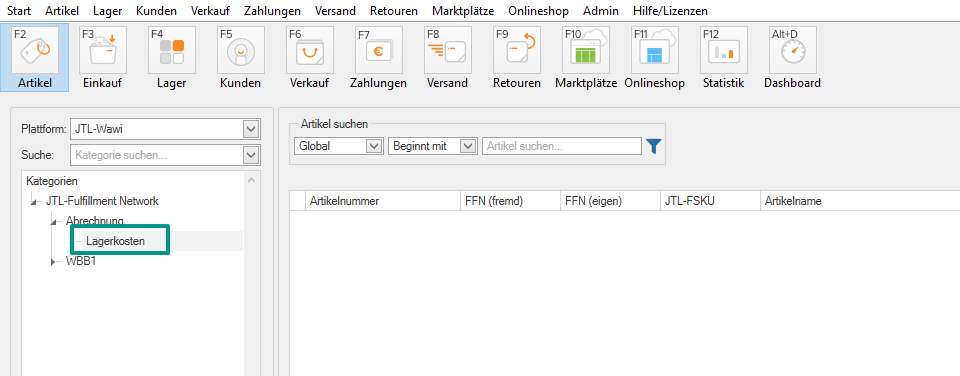

- In JTL-Wawi, create a new category for Abrechnung (Invoicing), if necessary. In our case, we also created the subcategory Lagerkosten (Storage costs). For a better overview, you can also create a separate invoicing category for each customer. See: Creating categories

- Create a new item and give it a unique name.

- Also specify the item price. Please note that the price for storage locations is calculated on the basis of the specified interval. If, for example, your interval is 1 month and the cost is 10 euros, enter 10 as the net sales price here.

Gross or net sales price? You will normally use net prices in a B2B scope. We therefore recommend maintaining only the Net sales price.

- You do not need to complete the rest of the information for the item. Save and close the item.

Finalising the invoicing process

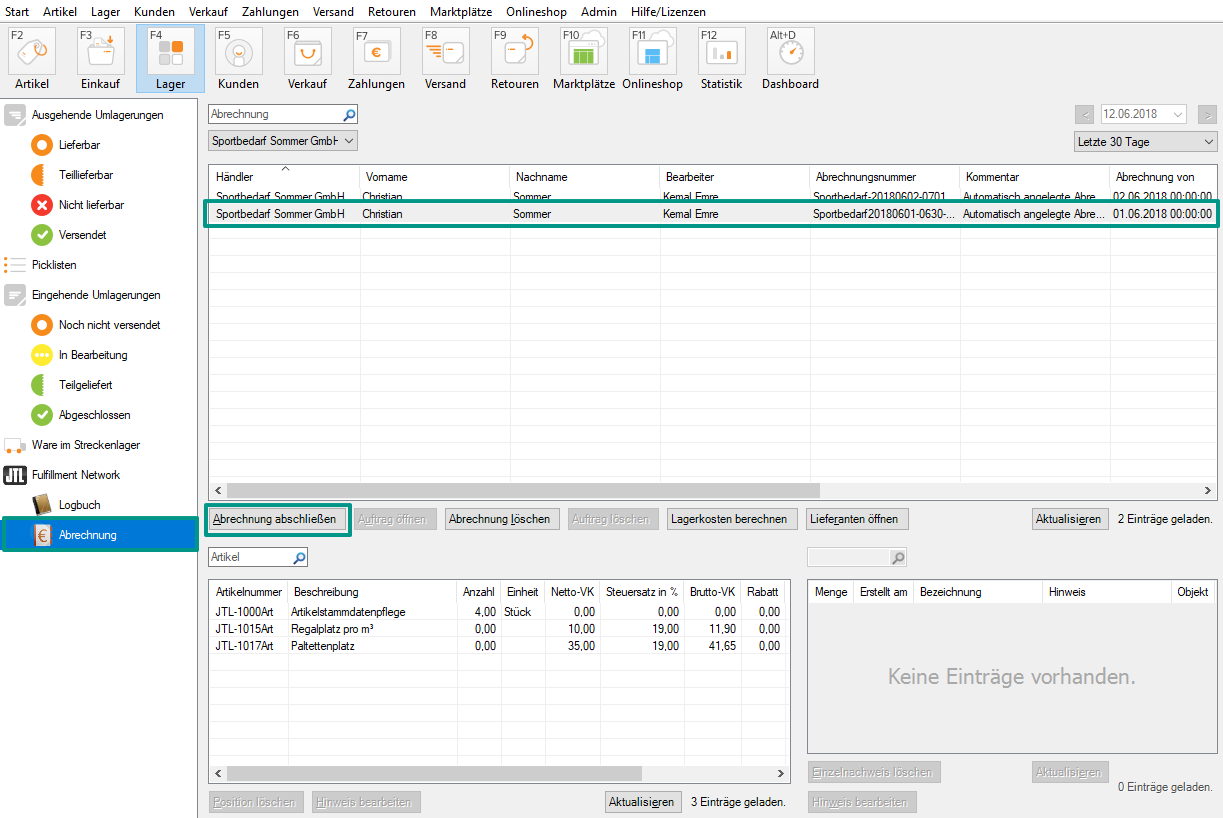

The next invoice is automatically generated at the end of the interval. You do not have to do anything else for this. As soon as an invoicing interval has ended, you can finalise the invoicing.

- Switch to the area Lager (Warehouses) and select the folder JTL-Fulfillment Network > Abrechnung (JTL-Fulfillment Network > Invoicing).

- In the drop-down menu above the list, select the fulfilment customer for whom you want to finalise the invoicing process.

- Select an invoice and click on Abrechnung abschließen (Finalise invoicing). A sales order that contains all accounting line items will now be created.

- If you want to edit the invoice before you send it, open the sales order and add more line items or remove unnecessary ones.

- Then click on Rechnung erstellen (Create invoice) to create the finalised invoice. You can now either email the invoice to the merchant directly from JTL-Wawi or print it out and send it by mail, for example.