We are currently still building up the English documentation; not all sections have been translated yet. Please note that there may still be German screenshots or links to German pages even on pages that have already been translated. This guide mostly addresses English speaking users in Germany.

Entering press items without master data

All press items sold in accordance with the §16 GWB price fixing regulation are identified according to GS1 standards. These include magazines, newspapers, special edition issues, novels, comics, brain teasers, and catalogues.

The price is included in the press code, eliminating the need to create item master data at the retail level. The scanner is able to directly retrieve the sales price from the GTIN bar code during checkout. This is done by means of the bar code prefixes.

Displaying press items uniformly on receipts and documents

Your task/initial situation

Requirements/restrictions

Displaying press items uniformly on receipts and documents

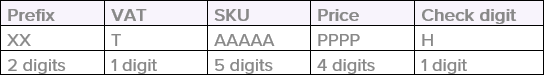

Modifying the predefined scheme: In order to use a uniform identifier on receipts and documents for line items from press codes, several control keys can be defined for a bar code scheme. GS1 uses different prefixes for this. 419 is used for press items with a reduced VAT rate and the prefix 414 for those with a full VAT rate. These key values are then split. 41 remains a prefix and the third digit (4 or 9) represents the different VAT rates:

In the following step, JTL-POS gives you the option to define a key value for each tax rate in the database.

Additionally, in both cases the GS1 Germany title number corresponds to the SKU (see entry value) that is assigned to the line item when it is entered on the receipt. The price and check digits offer no further options and are applied by default.

Step 1: Create a bar code scheme

- Go to Settings in the main menu.

- Scroll down to the cash register section and click on the User-defined bar codes menu item.

- Click on the green button in the bottom right-hand corner to create a new bar code scheme.

- In the Name field, enter a name for the bar code scheme. This will be displayed as an item or line item on receipts and documents. For example, “Magazine”.

- Scroll down and click on Edit scheme.

- Define the bar code scheme and save it by clicking Apply.

Step 2: Define key values

In the next step, define the key values according to how the bar code scheme is recognised by JTL-POS:

- In the first two Prefix fields, enter the key value 41.

- In the example below, for the third digit we enter the key values 4 or 9 for the VAT text field.

- Save the bar code scheme.

As long as no search results are returned in the item database during the checkout process, JTL-POS will immediately check whether the criteria of the bar code scheme are fulfilled and will ring up the respective item. Any data available in the bar code and specifications stored in the recognised tax rate will apply to the line item.

Related topics