We are currently still building up the English documentation; not all sections have been translated yet. Please note that there may still be German screenshots or links to German pages even on pages that have already been translated. This guide mostly addresses English speaking users in Germany.

Entering tax information

Your task/initial situation

Entering tax information

- Click on the Customers icon to go to the customer overview in JTL-Wawi.

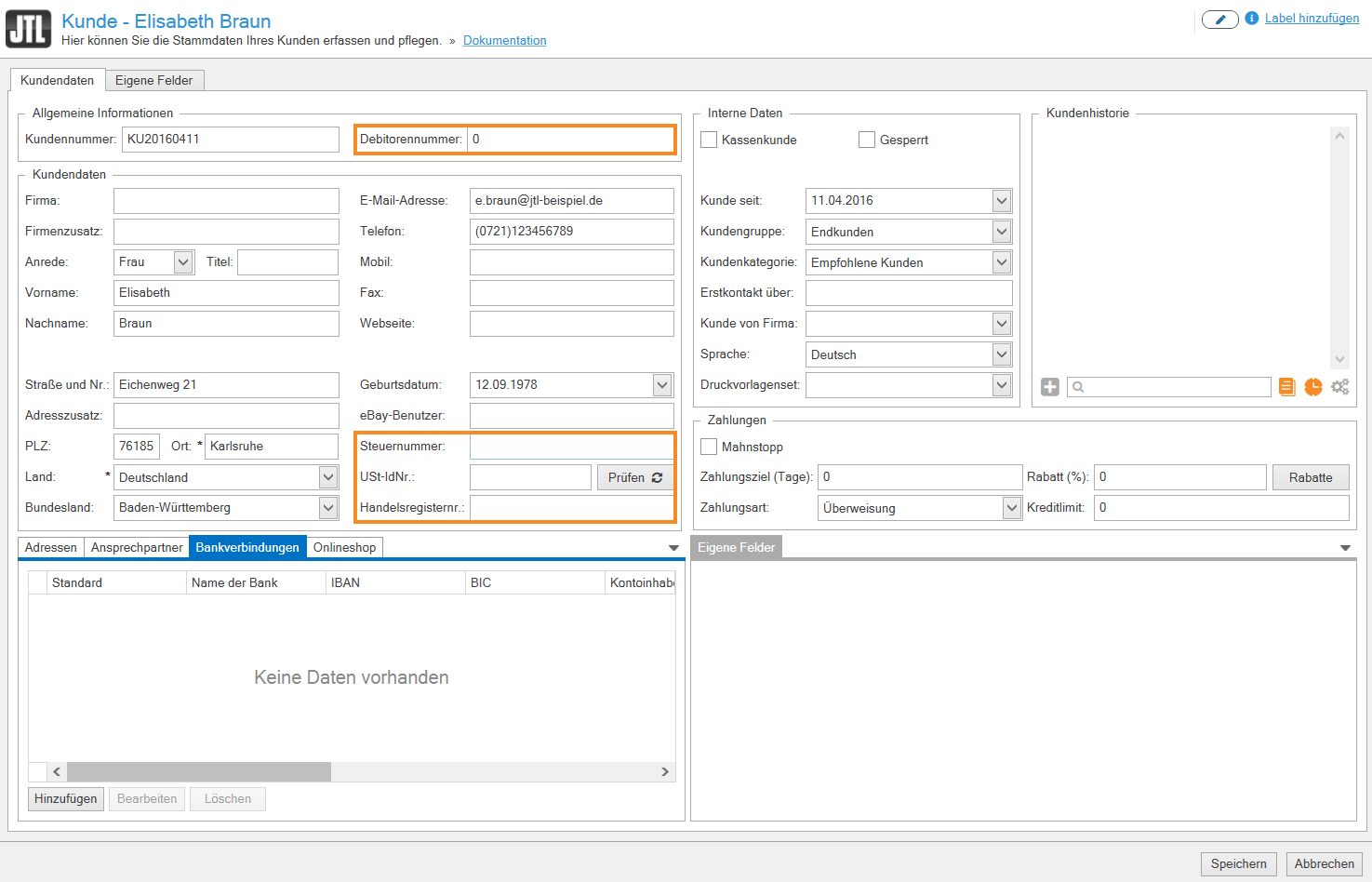

- Find the customer you want to edit in the overview or via the search and filter functions.

- Double-click on the customer master data.

- In the General information and Customer data area, you can now store the required data.

- Close the customer master data by clicking Save. The tax information is now stored in the customer master data.

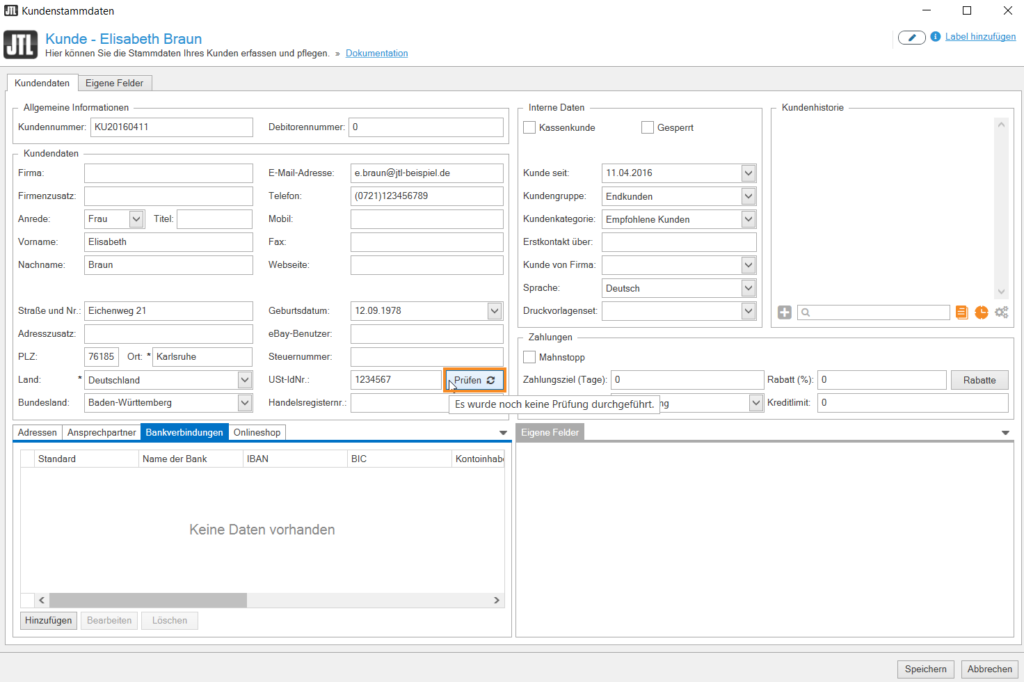

Checking the VAT ID

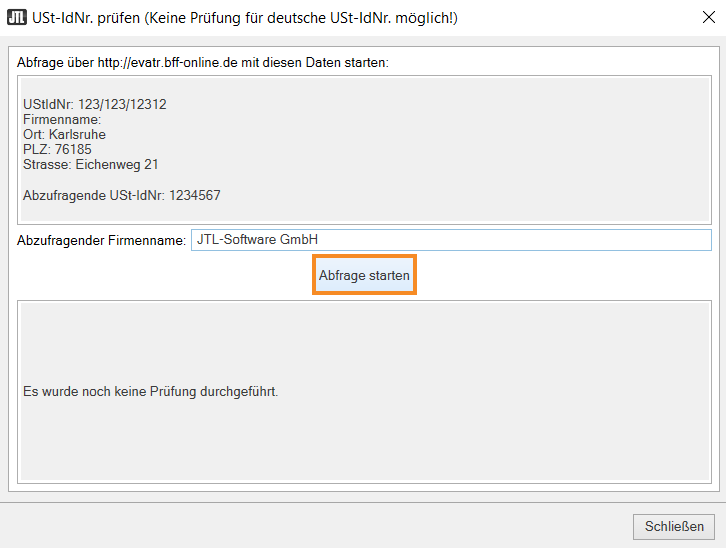

Via the Check button, you can check the entered VAT ID. If your registered office is in Germany, but the VAT identification number to be checked is from another EU country, the check will take place via https://evatr.bff-online.de/eVatR/. If the VAT identification number to be checked is from Germany or if your registered office is not in Germany, the check will be carried out via http://ec.europa.eu/taxation_customs/vies/vatRequest.html.

- Click on the Check button. The Check VAT ID dialogue box opens.

- Click Start request.

Further information on checking the VAT ID can be found on the website of the finance authority of your country or the European Commission.

Checking VAT IDs from JTL-Wawi version 1.5.45 (Only relevant to merchants based in Germany)

The process to check the VAT ID remains the same. However, the printing function and thus the postal certificate of the examination of the “Bundeszentralamt für Steuern” (German Federal Central Tax Office) is obsolete. The proof of the check is now displayed as an entry in the customer history. Double-clicking on the entry opens the result transmitted by the “Bundeszentralamt für Steuern”. A screenshot of this is sufficient as proof.

If your tax accountant requires a mass proof, use the following SQL to obtain the data for a specific period:

SELECT tKunde.cCustomerNo, historie.cValue1 as cTest result, historie.dErstellt

FROM [Kunde].[tHistorie] history

JOIN tKunde ON tKunde.kKunde = history.kKunde

where historie.kProcess = 46 and IsNull(cValue2, '') = ''

and historie.dErstellt > '01/01/2011' -startzeit ab dem suchen werden

AND historie.dErstellt < '31/12/2021' -- Entzeitpunkt

order by historie.dErstellt DESC